Up to 24 Months

Maximum Repayment Term

Up to 95% LTC

Available to Qualified Borrowers

$75k-$100M

Loan Amount Available

Who Qualifies

Minimum Requirements for New Construction Loans

with Huge Capital Funding

660+ Credit Score

Plans + Permits In Process

20% of Purchase Price Liquid

*Meeting Minimum Requirements Does Not Guarantee Approval. Several factors are considered in underwriting decisions, including, but not limited to the requirements listed above.

**Stronger profiles typically own the land free and clear while having 700+ credit, plans and permits in place and experience in 3 or more ground up construction projects. These borrowers get the lowest rates, less closing costs and require less money down..

What is a New Construction Loan?

New Construction Loans are short-term financing solutions tailored for real estate investors and builders developing a property from the ground up. These loans typically cover the purchase of land (if needed) and fund the costs of construction throughout various project phases.

Rather than basing approval on current property value, construction loans are structured around the future value of the completed project. During construction, borrowers usually make interest-only payments, helping manage cash flow while the build is in progress.

Once construction is complete, borrowers have the option to refinance into a long-term loan such as a DSCR loan or sell the finished property for profit.

This type of financing is ideal for investors looking to maximize returns through ground-up developments or major rehabs. New construction loans offer flexibility and scalability, making them a powerful tool for investors ready to take on larger, value-driven projects.

Benefits of a New Construction Loan

with Huge Capital Funding

Interest Only Payments

Only pay interest during the build phase—keep monthly costs low while your property takes shape.

Land & Construction Covered

Finance both the lot purchase and construction costs in one loan—no need for separate funding sources.

Based on Project ARV

Loans are underwritten using the After-Repair Value (ARV) of the completed project, allowing for higher leverage.

Turn Your Blueprint Into Reality

Get a New Construction Loan In 3 Simple Steps

with Huge Capital Funding

Complete Your Application

Start with our fast, online form—designed to take just minutes.

Receive a Personalized Offer

One of our funding experts will send you a tailored term sheet to review.

Receive Your Funds & Close

Close the deal and receive your funds!

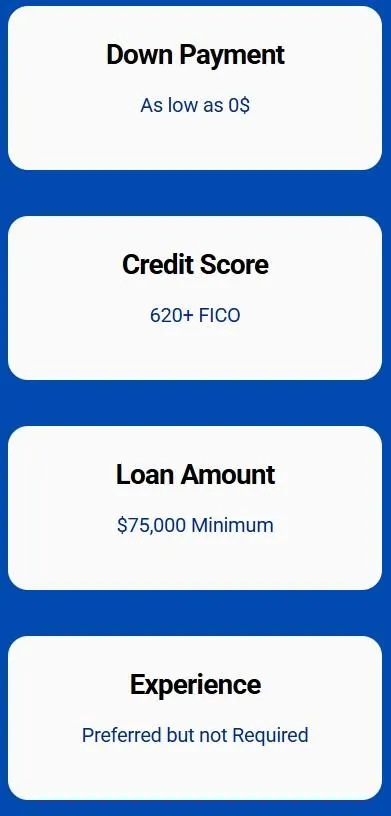

Are We a Match? Here’s What Most Qualified

New Construction Loan Applicants Look Like:

Credit Score

620+ FICO

Loan Amount

$75,000 Minimum

Down Payment

As low as 0%

Experience

Preferred but not Required

Get a New Construction Loan

with Huge Capital Funding

FAQ's

What is a new construction loan?

A New Construction Loan is short-term financing used to fund the ground-up development of residential or commercial properties. It covers the cost of land, labor, and materials throughout the building process.

Can I use a construction loan to buy land?

Yes. The loan can be used to purchase land as part of the project. If you already own the land, its value can be used as equity toward your down payment or project funding.

How does the draw process work?

Instead of receiving the full loan amount upfront, funds are released in draws payments issued at key phases of construction (foundation, framing, roofing, etc.). Each draw is approved after inspection or submission of completed work documentation.

Do I make full payments during construction?

No. Most construction loans are interest-only during the build, meaning you only pay interest on the funds drawn. This keeps your monthly payments lower until the project is complete.

Can I build under an LLC?

Yes. Most lenders allow you to structure the loan in an LLC or business entity, which is ideal for liability protection and long-term portfolio management.

What is the typical loan term?

Terms range from 6 to 24 months, with extension options available. Most loans are structured to align with the expected construction timeline.

“You don’t need to know everything about funding — you just need someone who does, and who actually gives a damn about your outcome.”

Offers presented by Huge Capital are conditional and subject to third-party lender approval. Final terms depend on underwriting criteria, creditworthiness, business financials, and lender-specific requirements. Same-day or expedited funding is not guaranteed and may vary by lender, product, and time of application.

Huge Capital is not always a direct lender. We may broker financing through a vetted network of funding partners. Some underwriting decisions are made by third-party institutions, and offers are extended based on lender terms. Clients have the option to accept or decline any offer received.

Huge Capital does not perform hard credit inquiries for prequalification. However, some lenders in our network may require full documentation or credit verification before final approval. Loan terms and conditions, including interest rates and repayment schedules, vary by lender and applicant profile.

Not all industries or business types are eligible for funding. Certain restrictions may apply based on lender guidelines and state laws.

Huge Capital makes no guarantees of approval or specific funding amounts. The total capital available depends on business credit, revenue, existing liabilities, and the lender's risk assessment.

Loans and funding products are subject to change without notice. Huge Capital is located at 930 S 4th St, STE 209, Las Vegas, NV 89101.